3 Simple Techniques For Bank Account Number

Wiki Article

8 Simple Techniques For Bank Certificate

Table of ContentsThe 2-Minute Rule for Bank CodeThe Main Principles Of Bank Account Number The Only Guide to Bank Account NumberHow Banking can Save You Time, Stress, and Money.Bank Code Fundamentals Explained

When a financial institution is perceivedrightly or wronglyto have issues, customers, being afraid that they could shed their down payments, may withdraw their funds so quickly that the little portion of fluid assets a financial institution holds comes to be swiftly exhausted. During such a "work on deposits" a financial institution might have to offer various other longer-term as well as less fluid assets, often at a loss, to fulfill the withdrawal demands.

Regulatory authorities have broad powers to interfere in troubled banks to decrease interruptions. Laws are normally made to restrict financial institutions' direct exposures to credit rating, market, as well as liquidity risks and to overall solvency danger (see "Protecting the entire" in this concern of F&D). Financial institutions are now needed to hold even more and also higher-quality equityfor instance, in the form of retained revenues as well as paid-in capitalto barrier losses than they were before the monetary situation.

What Does Bank Draft Meaning Mean?

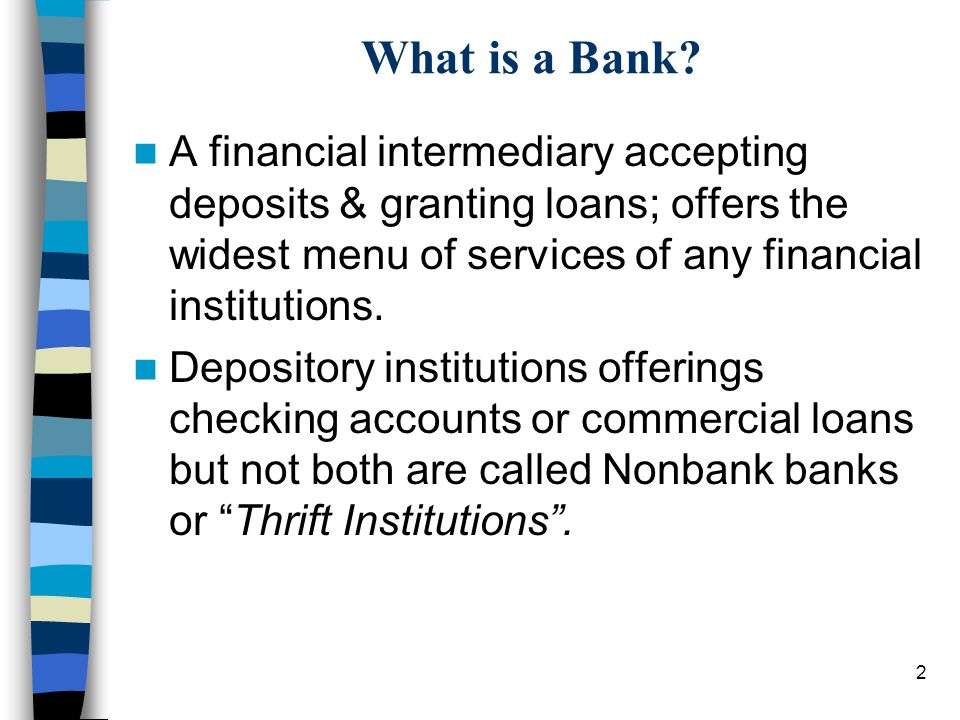

A bank is a banks licensed to offer solution choices for customers that wish to save, obtain or accrue even more money. Financial institutions generally accept down payments from, and deal financings to, their clients. They may additionally use check- cashing or providing services, credit history or debit cards, and insurance coverage options. Banks are not the only place where you can look for financial solutions; check-cashing businesses Can help you get funds without a bank inspecting account.While financial institutions may provide comparable economic solutions as credit unions, banks are for-profit services that route many of their economic returns to their shareholders. That means that they are less likely to provide you the finest possible terms on a finance or an interest-bearing account. Think about a bank as the intermediary that manages and enables a connected chain of interrelated financial activities.

Those consumers after that pay the financing back to the financial institution, with interest, over a set time (bank account). As the customers pay off their loans, the financial institution pays a fraction of the paid interest to its account owners for enabling it to use the transferred money for issued financings. To additionally your personal and also service rate of interests, financial institutions supply a large selection of monetary services, each with its very own positives and downsides depending on what your cash motivations are and also how they could progress.

Not known Facts About Bank Statement

Banks are not one-size-fits-all procedures. Various kinds of clients will discover that some banks are better economic partners for their goals and needs than others.The Federal Reserve regulates various other financial institutions based in the U.S., although it is not the only government agency that does so. Community financial institutions have less possessions because they are unconnected to a significant nationwide bank, however bank example they offer economic solutions across a smaller geographical impact, like a region or area.

On-line banks do not have physical places but often tend to supply much better interest prices on car loans or accounts than financial institutions with physical places. Deals with these online-only establishments usually happen over a web site or mobile application and hence are best for somebody who does not call for in-person support and is comfy with doing most of their banking digitally.

Facts About Bank Certificate Revealed

(C) U.S. Bancorp (USB) Unless you prepare to stash your cash money under your cushion, you will eventually need to engage with a banks that can secure your cash or problem you a loan. While a bank may not be the organization you ultimately select for your monetary requirements, recognizing just how they run and also the solutions they can give can aid you determine what to look for when making your selection.Bigger banks will likely have a bevy of brick-and-mortar branches and ATMs in convenient areas, along with countless electronic banking offerings. What's the difference in between a financial institution as well as a lending institution? Since banks are for-profit establishments, they often tend to use less attractive terms for their clients than a cooperative credit union may supply to maximize returns for their capitalists.

a long elevated mass, esp of earth; mound; ridgea incline, since a hillthe sloping side of any hollow in the ground, esp when surrounding a riverthe left bank of a river gets on a viewer's left looking downstream an elevated area, rising to near the surface area, of the bed of a sea, lake, or river (in mix) sandbank; mudbank the location around the mouth of the shaft of a mine the face of a body of orethe side inclination of an aircraft regarding its longitudinal axis during a turn, Additionally called: banking, camber, cant, superelevation a bend on a roadway or on a railway, athletics, biking, or other track having actually the outside constructed more than the within in order to lower the impacts of centrifugal force on cars, runners, and so on, rounding it at bank exam books rate and also in many cases to promote drainagethe pillow of a billiard table. bank certificate.

The Best Guide To Bank Reconciliation

You'll require to give a financial institution declaration when you make an application for a lending, file taxes, or apply for separation. Packing Something redirected here is loading. A bank declaration is a file that summarizes your account activity over a particular amount of time. A "declaration duration" is normally one month, but it might be one quarter in some situations.

Report this wiki page